ESG Reporting Frameworks: Comparing CDP, GRI & More

By now, you’ve no doubt heard about the rise of ESG reporting. And you may also be familiar with established ESG reporting frameworks like CDP and GRI.

But as more companies seek to report on their environmental and social impacts, a growing number of organizations have developed ESG standards to report against. And while GRI and CDP still dominate, other frameworks are growing in popularity.

Lisam has put together a list of ESG reporting frameworks you’re likely to encounter, who they’re for, and how they’re different.

How many ESG reporting frameworks are there?

Today there are no less than a dozen major ESG reporting frameworks in existence — each with their own metrics, methodology, and scoring system. These reporting frameworks become the basis for how companies set KPIs, what they measure, and what information goes in the sustainability reports they create.

One reason for the growing number of ESG reporting frameworks is the wide variety of companies that are now participating in reporting. Different industries have different ESG aspects and impacts, so understandably they will need to report on different metrics. Likewise, different stakeholders such as investors, regulators, and customers are interested in different types of information.

Thus, each standards body has developed its own frameworks to meet these needs, often building off the other standards that came before it.

Top 5 ESG Reporting Frameworks

- CDP

- CDSB

- GRI

- IIRC

- SASB

Carbon Disclosure Project (CDP)

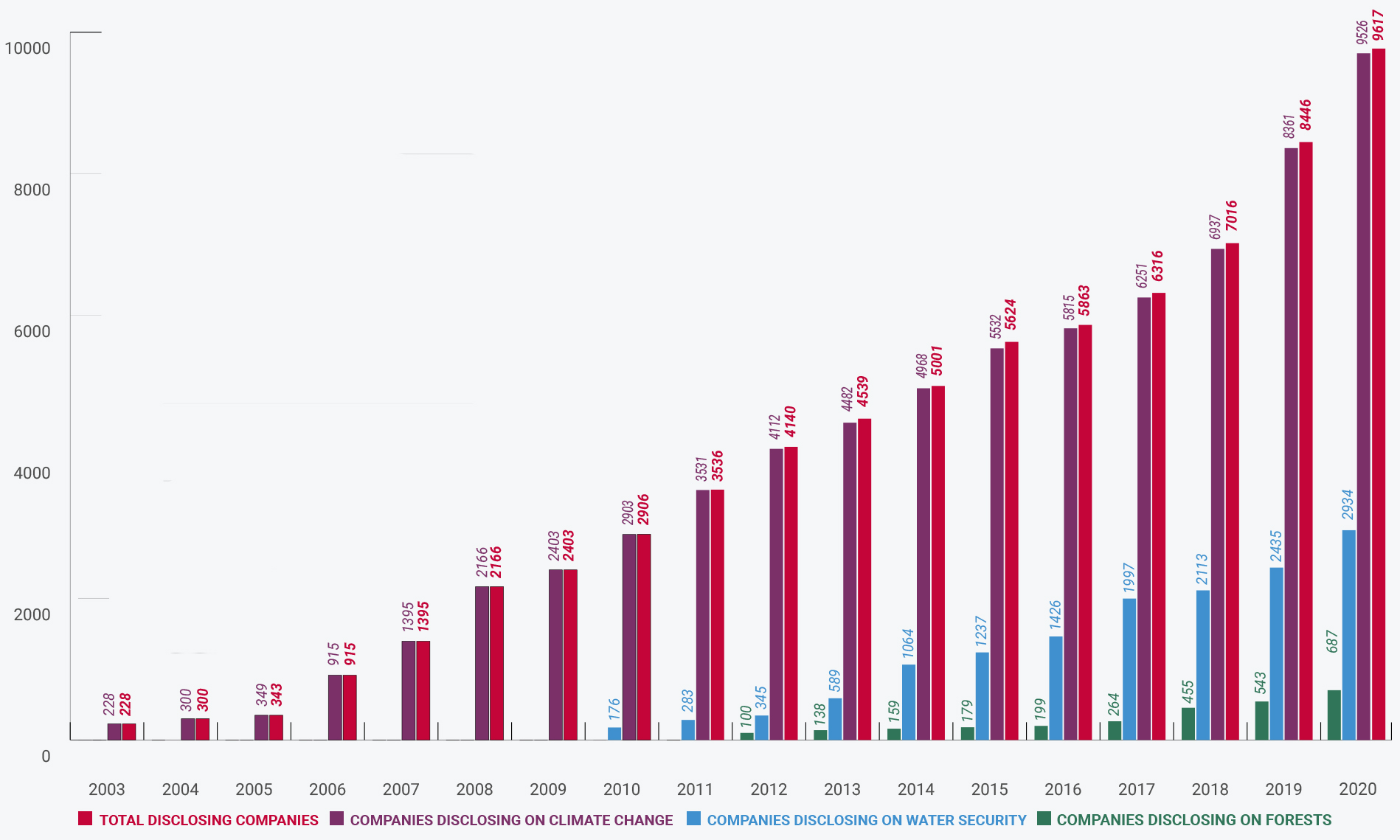

The Carbon Disclosure Project, or CDP, was founded in 2000. The idea was simple: to link environmental integrity and fiduciary duty. Today, more than 9,600 companies along with 800 cities, states, and regions worldwide disclose their environmental impacts through CDP, making it one of the most widely used reporting frameworks.

Each year, the CDP takes the information supplied through its annual reporting process and scores companies based on their environmental transparency and action. These scores, along with CDP data, are used by investors to inform their decisions. Companies that score well on CDP gain a competitive advantage over their peers. Scores can also be used internally as a tool to benchmark progress and ensure their strategies are aligned with current best practices.

As the name implies, CDP focuses primarily on climate impacts such as carbon emissions, water usage, and deforestation. Companies that wish to report on social and governance factors will need to use a secondary reporting framework.

Source: CDP

Climate Disclosure Standards Board (CDSB)

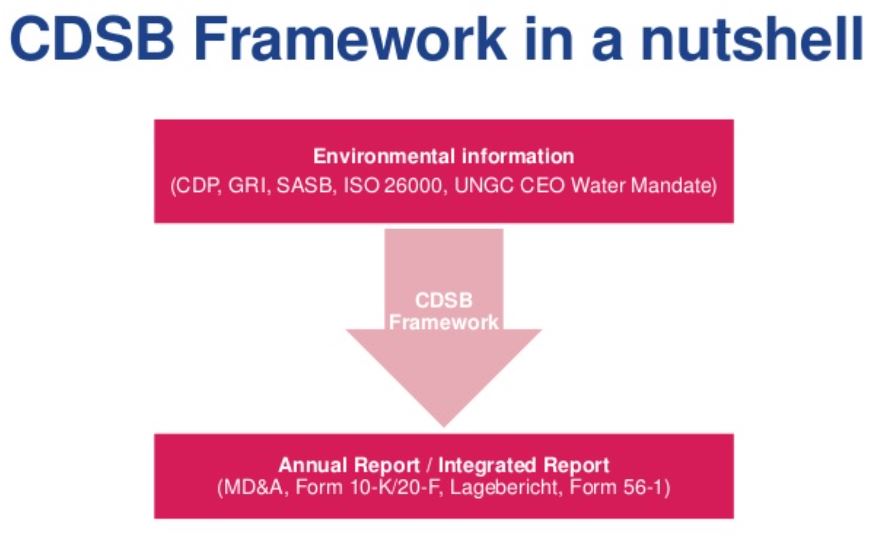

The Climate Disclosure Standards Board (CDSB) was founded in 2007 at the World Economic Forum (WEF) annual meeting, and the CDSB Framework was released in 2015. Like CDP, the Climate Disclosure Standards Board (CDSB) Framework is heavily focused on reporting environmental information. However, CDSB differs in a few key ways.

While CDP provides a structure for collecting data for reporting, CDSB aims to integrate climate change-related disclosure into mainstream financial reports such as annual reports and 10-K filings. By doing so, CDSB hopes to encourage connections between sustainability and corporate strategy.

The CDSB Framework does not specify its own metrics and KPIs for reporting. Rather, it relies on metrics and KPIs developed by other standards organizations like CDP, as well as GRI, WRI, WBCSD, and SASB.

Source: CDSB

The most recent version of the CDSB Framework closely aligns with the recommendations from the G20 Task Force on Climate-related Financial Disclosures (TCFD) recommendations, making it a useful tool for companies that want to implement the task force’s recommendations. It is also a method of complying with environmental disclosure regulations such as the European Union (EU) Non-Financial Reporting Directive.

The CDSB Framework is currently used by 374 companies across 32 countries and 10 sectors, including Nestlé and Coca Cola.

Global Reporting Initiative (GRI)

Launched in 1997, the Global Reporting Initiative (GRI) was the first global standard for sustainability reporting. It was developed by the Coalition for Environmentally Responsible Economies (CERES) and the United Nations Environment Programme (UNEP) in response to the Exxon Valdez oil spill.

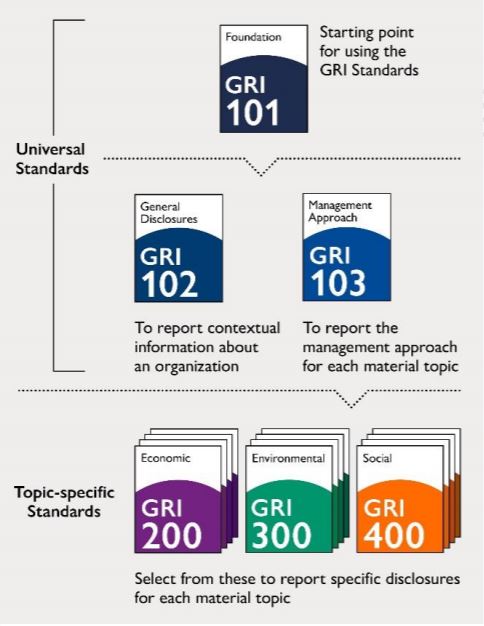

Thirty years later, GRI remains the most widely used ESG reporting framework. More than 13,000 organizations in 90 countries have used GRI for their sustainability reporting, and the standards have been translated into a dozen languages. Today, over 80% of the world’s 250 largest corporations use GRI. However, the GRI framework is just as useful for small companies as it is for large global enterprises.

Source: Global Reporting Institute

Part of what makes GRI so useful is its flexibility. There are three Universal Standards that are used by every organization. Organizations can also choose from relevant Topic Standards to prepare reports for specific users or purposes, such as investors or stakeholders.

Furthermore, the GRI standards are always evolving. For example, GRI is currently revising its standards to improve human rights reporting. All GRI standard-setting activities are governed by the Global Sustainability Standards Board.

International Integrated Reporting Council (IIRC)

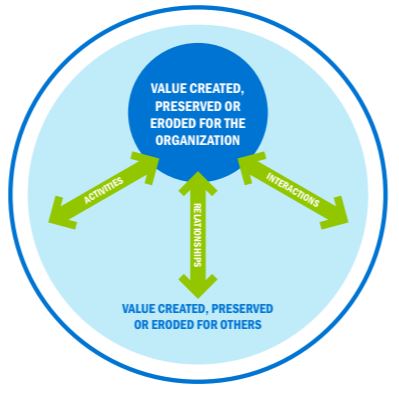

First released in 2013, the IIRC’s International Integrated Reporting Framework (IRF) was a landmark development in market-led corporate reporting.

The IIRC’s vision was to put an end to the numerous, disconnected corporate reports companies were creating and replace them with an integrated approach that would “explain to providers of financial capital how an organisation creates, preserves or erodes value over time”. In short, the IRF would make sustainability information available to investors, lenders, and insurers in a concise format.

Source: IIRC

Like GRI, the IIRC’s framework includes environmental, social, and governance (ESG) aspects. IRF specifies the key content elements to be included in reports, including governance, business model, risks and opportunities, strategy and resource allocation, performance, outlook, basis of preparation and presentation.

Updates to the IIRC framework in 2021 further streamlined the reporting process for preparers. The updates also focus on providing better quality insights for users of information. IIRC estimates that 1,600 companies across 64 countries are working toward integrated reporting.

Sustainability Accounting Standards Board (SASB)

Another late 2010s development, the SASB standards are a set of 77 industry standards companies can use to identify and report financially material sustainability information to their investors.

What makes SASB unique is that it lays out specific sustainability topics and related metrics for each industry, such as transportation, utilities, and oil and gas. This makes it particularly useful for organizations that need some help determining which disclosure topics are financially material to their business and which metrics to report.

Source: SASB

Overall, SASB covers many of the same issues as other standards like GRI. However, SASB tends to look at sustainability impacts through a narrower financial lens, while GRI is focused on broader organizational impacts. For this reason, many companies opt to report with both SASB and GRI. Over 120 companies are currently using the SASB standards, including JetBlue, Nike, and General Motors.

Final thoughts

While there are some significant differences between the various ESG reporting frameworks, clearly there is a lot of overlap. This has created confusion for both the preparers and users of ESG reports.

Many investors and companies have argued that a standardized ESG reporting framework is necessary in order to simplify understanding. Having a single, universal framework would make it easier for companies to identify and report on ESG performance. And, it would make it easier for investors to compare different companies’ sustainability reports.

As ESG disclosure becomes more mainstream, these five leading sustainability organizations have taken steps toward a more unified reporting system. Recently, CDP, CDSB, GRI, IIRC, and SASB announced their intent to collaborate toward comprehensive corporate reporting. Only time will tell how this will go, but one thing is for sure: ESG disclosure is here to stay.

Lisam offers a simple ESG management system to help you track and report on sustainability performance — no matter which framework you’re using. Learn more by requesting a free demo today.

Next, explore the benefits of ESG.