What Is the New SEC Climate Disclosure Rule? And What Does It Mean for EHS Professionals?

If you’re an EHS professional, you’ve likely heard about the new climate disclosure rule that was proposed by the U.S. Securities and Exchange Commission (SEC) on March 21. The rule will have a major impact on the way EHS professionals approach their work. It will also have a major impact on how companies report their climate risks and impacts.

This blog will explain what is known about the proposed rule and what effect it would have on corporate disclosure.

Before we dive into that, let’s take a quick look at where companies stand today regarding climate disclosure. Nearly a quarter (23%) of companies see climate change as one of the top three risks that could have a material impact on their business, according to the 2021 S&P Global Corporate Sustainability Assessment. The Task Force on Climate-related Disclosure (TCFD) found that over 50% of firms are disclosing their climate-related risks and opportunities. With that said, it also found that the U.S. lags behind European countries when it comes to disclosure. In short, many U.S. companies are not ready for the new SEC rules, but they need to be.

What is the proposed SEC climate disclosure rule?

The proposed SEC climate disclosure rule would be the first mandatory federal reporting requirement of its kind in the U.S. It would require companies to report on how climate change could impact their financial performance. It would also require companies to report how their own emissions contribute to global warming. In that way, it shares some similarities with the European Union’s Non-Financial Reporting Directive (NFRD). This requires companies to publish regular reports on their environmental and social impacts, as well as the proposed Corporate Sustainability Reporting Directive (CSRD).

The SEC oversees stock exchanges and regulates the market. As such, the rule would apply to U.S. listed companies. In other words, it would apply to publicly traded companies that are listed on the stock exchange. For now, privately held companies would not be subject to the rule. However, the SEC has said that it aims to mandate disclosures for large private companies as well.

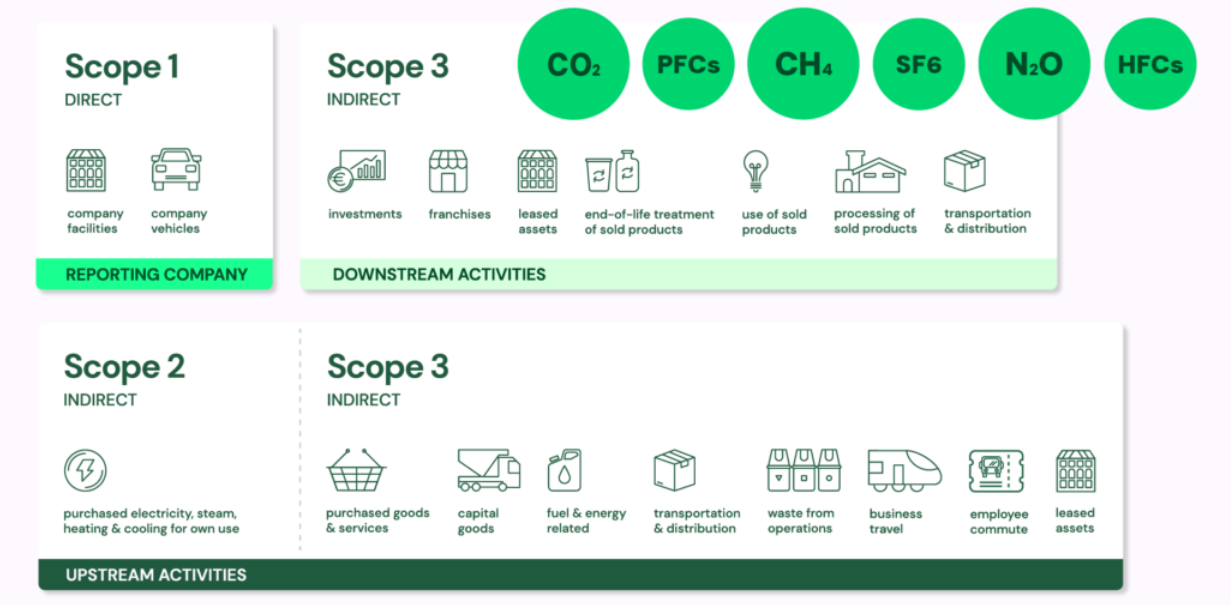

There are two important parts to the proposed SEC rule that we want to highlight. First, it would require listed companies to disclose any climate-related risks that could potentially affect their financial stability. This would include risks like severe weather, the costs of transitioning from fossil fuels, and new regulations such as a possible carbon tax. Second, it would require companies to disclose their carbon emissions. Covered companies would have to report their direct and indirect emissions, also known as Scope 1 and Scope 2 emissions. They would also have to report any Scope 3 emissions, or those from their suppliers or partners, if they pose a material risk to the business or are included in its emissions reduction targets.

What does the SEC climate disclosure rule mean for you?

The proposed rule is open for public comments, and would likely be finalized later this year. It will of course face significant legal challenges from corporate groups including the U.S. Chamber of Commerce, which has vowed to fight parts of the rule. If it survives, however, we foresee three big changes for companies and EHS professionals:

1. The reporting burden will increase.

Obviously, any new reporting requirement is going to mean more work for EHS professionals. The SEC rule is no exception. It’s going to take time to understand the rule, its implications for tracking and reporting, and how to comply.

Under the new rule, companies are going to have to provide more granular reporting around climate risks within their operations, and in their value chains as well. That last part — the rules around Scope 3 reporting — are of particular concern for companies. While many companies currently report on Scope 1 (direct) and Scope 2 (purchased energy) emissions, the majority do not report on Scope 3 (value chain emissions). According to Reuters, corporate groups say that “providing [Scope 3 emissions] detail would be burdensome and would expose companies to litigation if third-party data ends up being wrong.” That said, the rule leaves it up to companies to determine if their Scope 3 emissions are financially material and therefore would need to be reported.

(Image credit: Plan A Academy based on GHG protocol)

Some companies have also expressed concerns around the feasibility of calculating climate change risks. Only a quarter of companies are currently using scenario analysis to gauge how future physical, regulatory, and market changes would impact their business, according to data from S&P Global.

2. The rule should help clarify reporting requirements.

On a more positive note, the new rule should make life easier in some ways. A major goal of the SEC rule is to provide consistent and comparable information for investors. In doing so, the rule will hopefully clarify reporting requirements for companies. SEC Chair Gary Gensler put it this way: “Companies and investors alike would benefit from the clear rules of the road proposed in this release.”

According to the SEC, the information companies will be required to disclose under the new rule would be similar to what they’re already disclosing under other frameworks, such as the Task Force on Climate-Related Financial Disclosures and the Greenhouse Gas Protocol. We’re hearing a similar message from some of our customers, who say that they’re already collecting the data on Scope 1, 2, and in some cases Scope 3 emissions that would be required under the new rule.

For those that have the right systems in place to capture operational data, it’s going to be more about plugging this information into the right format for reporting. Those that don’t have the tools to collect operational data to feed ESG reporting are going to want to start thinking about this as soon as possible so they’re not scrambling to catch up when the rule goes into effect.

3. It will open the door for more mandatory ESG disclosure rules.

While many other countries have adopted mandatory ESG reporting rules, there are no such federal rules in the U.S. — until now. In that sense, the SEC rule is a landmark for mandatory ESG reporting. If it survives legal challenges, it will almost certainly open the door for more ESG disclosure requirements in the future.

Previously, the SEC has said that it is “evaluating a range of disclosure issues under the heading of environmental, social, and governance, or ESG, matters.” It has asked commenters to weigh in on whether climate-related requirements should be one aspect of a broader ESG disclosure framework.

Mandatory ESG disclosure would help satisfy the demand from investors for more detailed, accurate information on companies’ ESG performance — so there’s a lot of pressure on lawmakers to get these rules passed. Globally, the number ESG reporting provisions issued by governmental bodies has grown 74% over the last four years. It’s only a matter of time before more mandatory ESG disclosure rules are adopted in the U.S. From our perspective, this is just another reason why companies need to be thinking seriously about investments in technology that can help track, measure, and report operational data for ESG performance.

Your takeaway

It will take weeks or months for the SEC to finalize the climate disclosure rule. A lot could change between now and then. Assuming that the proposed rule eventually goes into force, it will cause many companies to rethink the way they track, measure, and report on climate risks and impacts as they relate to financial performance.

The rule also gives us a hint what’s to come in the next decade for mandatory ESG reporting. The SEC ultimately plans to make climate disclosure mandatory for private companies as well, and is also looking at the climate disclosure rule as part of a broader ESG disclosure requirement in the future.

Companies that are already tracking operational data effectively and have the systems in place to accurately report on key metrics will have a leg up. Those that don’t, need to start getting them in place now. This will help them prepare if and when the new rules — and other future requirements — take effect.