4 ESG Report Examples to Get You Started With Your Own

Great writers know that one of the best ways to improve their writing is to read books from others in their genre. They’re able to discover the specific techniques other writers use to craft memorable characters, build suspense, and alternately, where they make mistakes and lose their readers’ interest. Likewise, there’s a lot to be gained by studying ESG report examples from other sustainability professionals. You can then apply what you learn to your own work.

This is particularly true for sustainability professionals at small-midsize companies, who may not have the same level of resources to invest in reporting as their larger counterparts.

With that in mind, we’ve rounded up 4 ESG report examples that do an excellent job of organizing information and presenting it in a compelling way. The list reflects a broad range of industries and levels of ESG disclosure maturity. Any company will be able to walk away with something useful to apply.

Featured Resource: Climate Risk Management Guide

What is an ESG report?

In the most basic sense, an ESG report is a document that communicates a company’s environmental, social, and governance performance and impacts. But reports can vary widely from one company to the next, and no two reports will look exactly the same.

For one, different reports have different audiences. A report that’s geared toward consumers will contain different information than one that’s written for investors or shareholders.

Companies also differ widely in their reporting maturity. The longer a company has been reporting on sustainability metrics and the more resources they devote to those efforts, the more detailed their reports typically are.

In addition, several organizations have developed ESG reporting frameworks that companies can use to guide their disclosure efforts. GRI, CDP, and SASB are common frameworks that companies are reporting against.

The best way to understand ESG reports is to look at some examples.

4 Great ESG Report Examples

- National Grid

- IEA Infrastructure

- Energy Recovery

- Compass Minerals International

National Grid

National Grid is a Perillon customer, and we regularly quote the team here on the Perillon blog. Naturally, we frequently look to National Grid as an example of a company that’s getting ESG right.

But don’t take our word for it. Earlier this year, S&P Global Ratings assigned National Grid an ESG evaluation score of 82/100. This reflects strong preparedness and overall effective management of environmental and social risks. In their report, S&P noted that National Grid’s “disclosure and reporting practices are more comprehensive than global peers, covering a wide range of financial and nonfinancial metrics, policies, governance information, and taxation issues”.

National Grid’s ESG reporting strategy

National Grid is no stranger to ESG disclosure: The company has been reporting on sustainability for two decades, since 2001. The energy company publishes a standalone ESG report. This is known as the Responsible Business Report, which is aligned with GRI and SASB. In addition, National Grid’s integrated annual report merges financial and sustainability information.

Publishing a standalone report allows National Grid to share much more comprehensive ESG information than would normally be included in an annual report. And unlike an annual report, which is typically geared toward shareholders and potential investors, National Grid’s Responsible Business Report is written for a wide range of stakeholders. This includes customers, regulators, colleagues, business partners, and suppliers.

The content of this 67-page report is extremely detailed — in the best way possible. It begins by clearly laying out National Grid’s vision and approach to responsible business. It then continues into full-blown information on the company’s environmental, social, and governance performance. But the entire time, there are helpful callouts and visual elements to supplement the text.

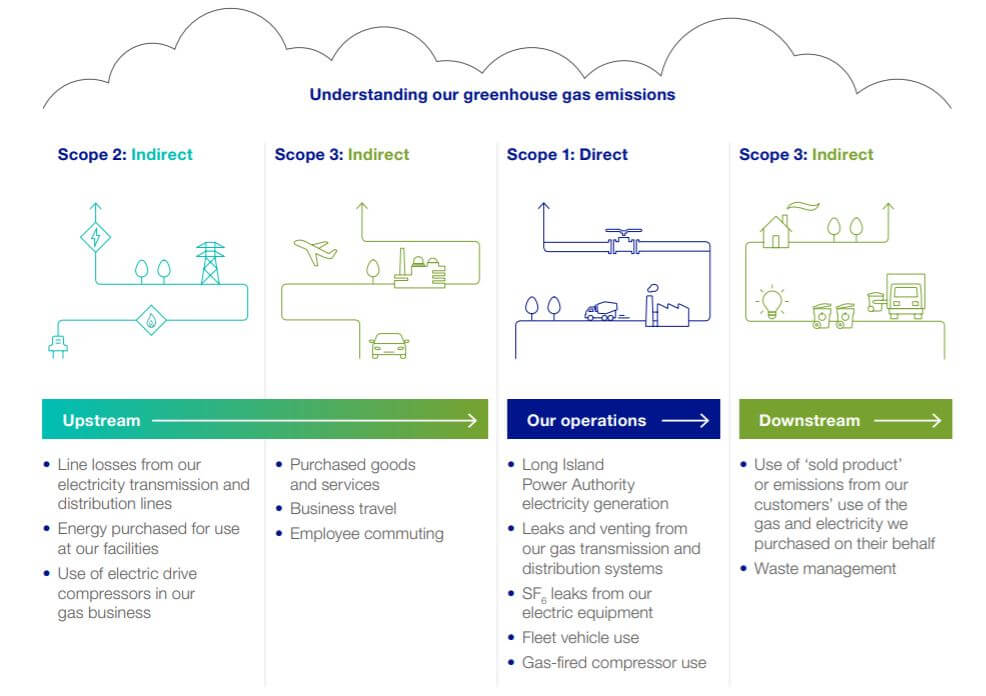

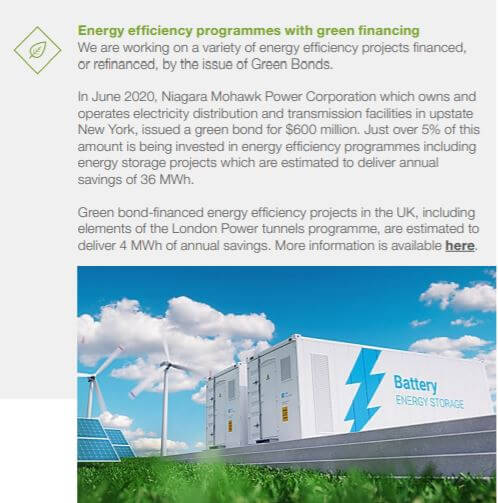

Instead of bombarding readers with statistics, well-designed graphics draw attention to key data — for instance, greenhouse gas emissions. These graphics are seamlessly inserted within large blocks of text to break up the report.

National Grid also uses thoughtfully placed case studies to illustrate its ESG programs in action. These case studies inject an element of warmth and human relatability that’s often missing from ESG reports.

“At National Grid, we have evolved our strategy and vision to reflect our belief that we have a responsibility to ensure that the energy future we help to shape is one where everyone shares the benefits and where we enable the communities we serve to deliver a clean transition.” — John Pettigrew, Chief Executive, National Grid

IEA Infrastructure

IEA is an Indiana-based construction engineering company that provides infrastructure management services for industries such as power, renewable energy, and railways.

A key player in the renewable energy space, IEA has completed 240+ wind and solar projects across 36 states, totaling over 21.5 GW. It has also established a cross-functional ESG leadership team to ensure environmental, social, and governance issues are integrated across the entire organization.

IEA published its first annual ESG report in 2020. It’s a great example of what disclosure might look like for an organization that’s just starting out with ESG reporting.

IEA’s ESG reporting strategy

For its first report, IEA chose to publish a standalone ESG report. This is a good strategy for a company that’s new to ESG disclosure, since building that type of report doesn’t require as much coordination with other departments across the company. The downside, of course, is that it doesn’t feel as integrated with the rest of the company’s strategy — which is something that may be important to investors and stakeholders. (That’s why many companies, like National Grid, publish both an ESG report and an integrated annual report.)

The first few pages of the report clearly outline IEA’s process, which included conducting a materiality survey as well as following the frameworks provided by The Task Force on Climate-related Financial Disclosures (TCFD) and The Sustainability Accounting Standards Board (SASB). This helps to answer the question, “How did we put together this report?” and “Why did we report on these specific issues?”.

The rest of the report is well-written and easy to understand. As you scroll through the document, you’ll notice that it reads more like a Powerpoint presentation than a research paper. Each page offers a bite-size amount of text — often favoring bullet points and graphics over huge walls of text. This makes the report easily digestible for casual readers.

Limitations of IEA’s reporting strategy

That said, any sustainability report is only going to be as good as the data it contains. Investors and regulators are increasingly scrutinizing companies’ ESG disclosure for signs of greenwashing, so having access to detailed sustainability data is a must.

IEA acknowledges that future ESG reports could benefit from greater depth. In the process of developing this first report, IEA says it identified areas where more data collection is needed. It also put tracking mechanisms in place to gather these additional metrics. We applaud IEA’s self-reflection and approach to continuous improvement.

“There is no doubt that the results in this report are meaningful and impactful; but it is important to me, personally and to the company, that we continually push ourselves to be better. This first report will help us do just that: act as a baseline that we can continue to improve upon in the years to come.” — JP Roehm, Chief Executive Officer, IEA

Energy Recovery

Energy Recovery Inc. manufactures energy recovery devices for oil and gas, chemical, and water industries globally. Its customers include national and international oil companies, exploration and production companies, oilfield services companies, hydraulic fracturing (“fracking”) operators, and more.

The company, which started in water desalination, has installed more than 20K energy recovery devices worldwide for 12.4M metric tons of carbon emissions avoided annually.

Like IEA, Energy Recovery Inc. published its first ESG report in 2020. The report was named one of the top 10 best first-time ESG Reports by the Corporate Register Reporting Awards. This is an award decided by the vote of more than 65,000 industry members.

Energy Recovery’s ESG reporting strategy

The sheer amount of information in the report is impressive: nearly 50 pages of detailed sustainability data. It’s even more impressive when you consider that this is Energy Recovery’s first ESG report.

Information in the report is aligned with leading sustainability frameworks, including SASB, GRI, and UN SDG. Energy Recovery clearly spells out the key issues and ties them to its products and operations in a meaningful way.

In the screenshot below, for example, Energy Recovery explains how its innovative Pressure Exchanger (PX) device can help contribute to the United Nations’ SDG 6: Clean Water and Sanitation.

Storytelling is a pivotal part of ESG reporting — and the Energy Recovery team are masterful storytellers. Customer and employee spotlights are sprinkled throughout the report. Each profile communicates Energy Recovery’s commitment to sustainability in a way that resonates with readers.

Compass Minerals International

Compass Minerals International (CMI) is a provider of essential minerals. This includes salt and magnesium chloride for use in road deicing and dust control, food processing, water treatment, and plant nutrition.

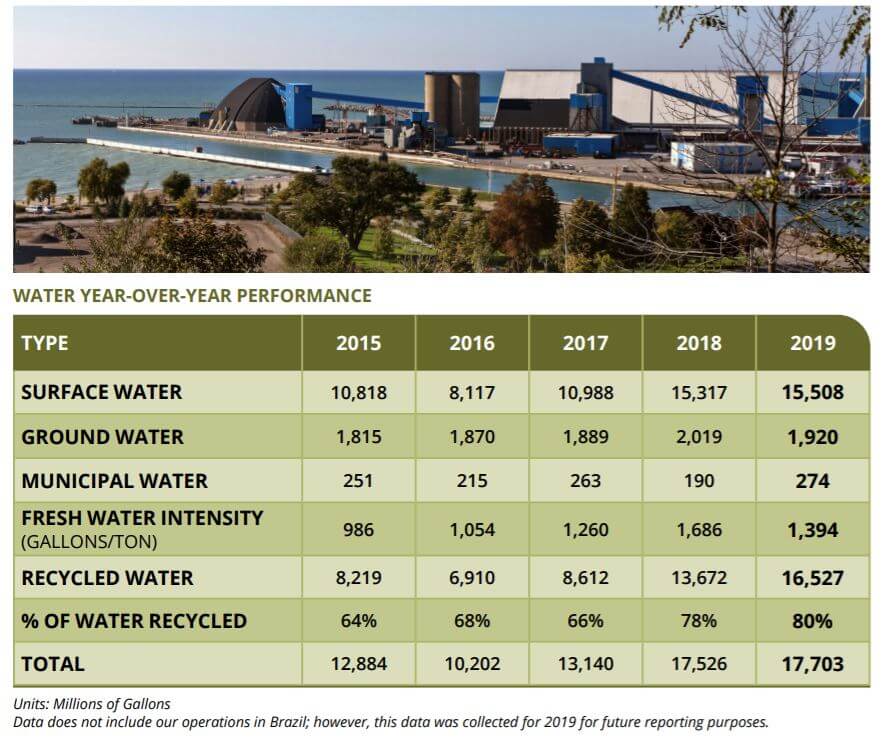

CMI has made significant strides toward sustainability, reducing its fresh water intensity 18% over the last year and its injury severity index by 55% over a 5-year period.

Like the other companies we’ve looked at, CMI publishes an annual ESG report that is aligned with leading sustainability frameworks — in this case, GRI and SASB.

Compass Minerals’ ESG reporting strategy

As you might imagine, navigating ESG reporting in the mining industry is particularly challenging. The industry faces significant environmental and social risks related to resource scarcity, safety, and human rights. Naturally, stakeholders are skeptical and expectations of transparency are high.

CMI’s report doesn’t shy away from these issues. Instead, it acknowledges them head-on, instantly establishing credibility with readers.

From a design standpoint, CMI’s report is thoughtfully laid out. It uses a mix of informative charts, eye-catching graphics, and attractive photography to illustrate key points and keep readers engaged. In addition, each section is color-coded — orange for workforce, green for environment, blue for governance — for easy navigation.

Conclusion

By studying these and other ESG report examples, you’ll be able to create a more compelling and effective ESG report for your own organization.

But knowing how to write and format an ESG report is just the beginning. Having access to detailed, accurate sustainability data is absolutely essential. Without it, any sustainability claims are just an opinion.

That’s where ESG management software comes in. ESG management software allows you to track sustainability metrics for a wide range of programs. From there, you can measure progress against your goals and make strategic decisions so that you can set the example.