Google Search Trends Show How ESG Is Evolving

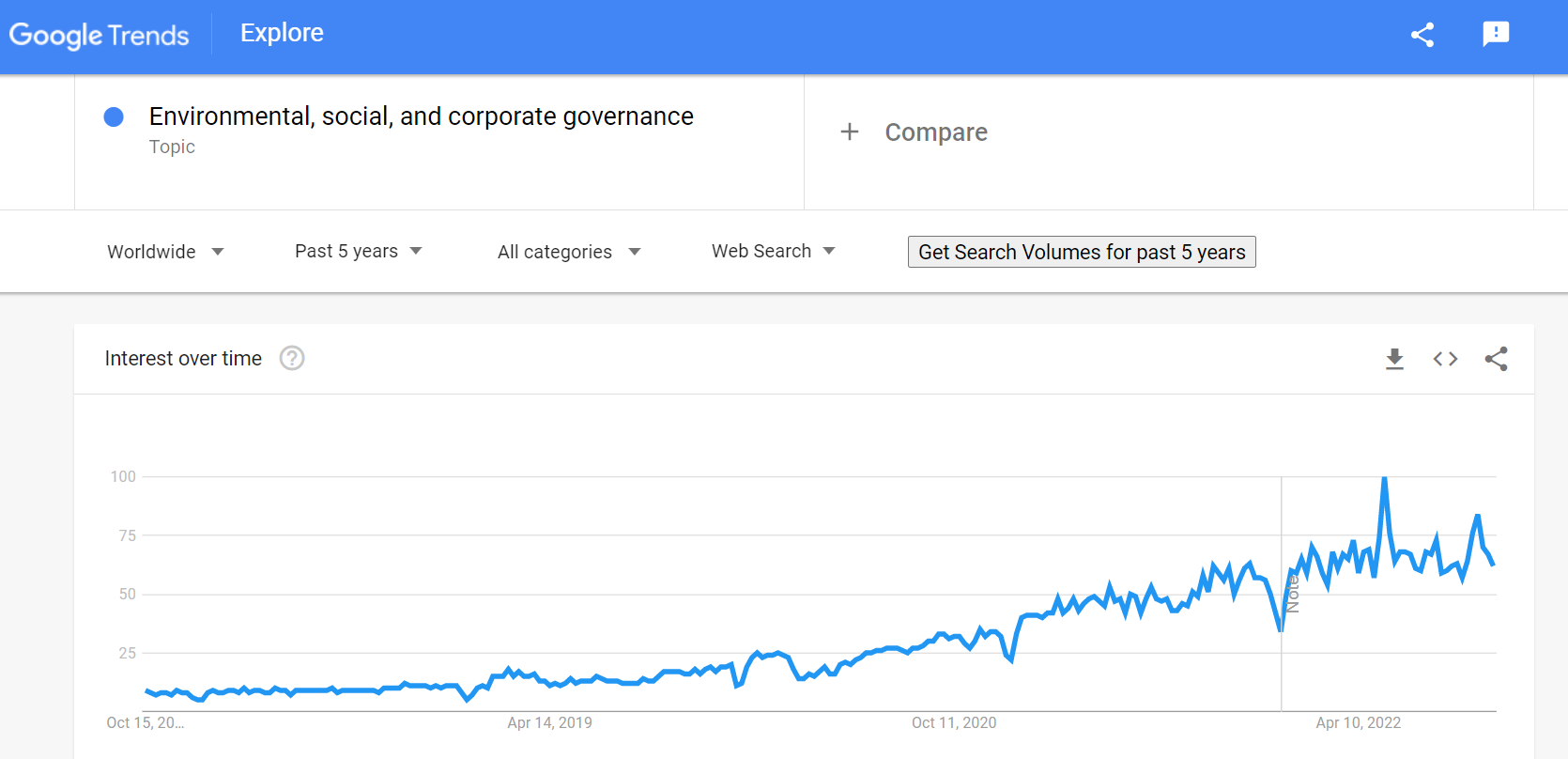

Google Search Trends data shows that the topic of environmental, social, and corporate governance (ESG) is twice as popular today as it was at the beginning of 2021. The data, which comes from an analysis of billions of search queries across various regions and languages, illustrates how the topic of ESG is evolving, and sheds light on how people and businesses are thinking about sustainability.

Rising interest in ESG

Worldwide search interest in ESG has been steadily trending upward since 2017, with the topic reaching peak popularity in September 2022.

Around this time, the European Union was preparing to adopt the Corporate Sustainability Reporting Directive (CSRD) — a new law requiring all large companies to publish regular reports on their ESG performance.

At the same time in the United States, SEC officials were busy meeting with institutional investors, asset managers, and other stakeholders regarding its proposed climate disclosure rules that would require public companies to disclose their climate risks and impacts.

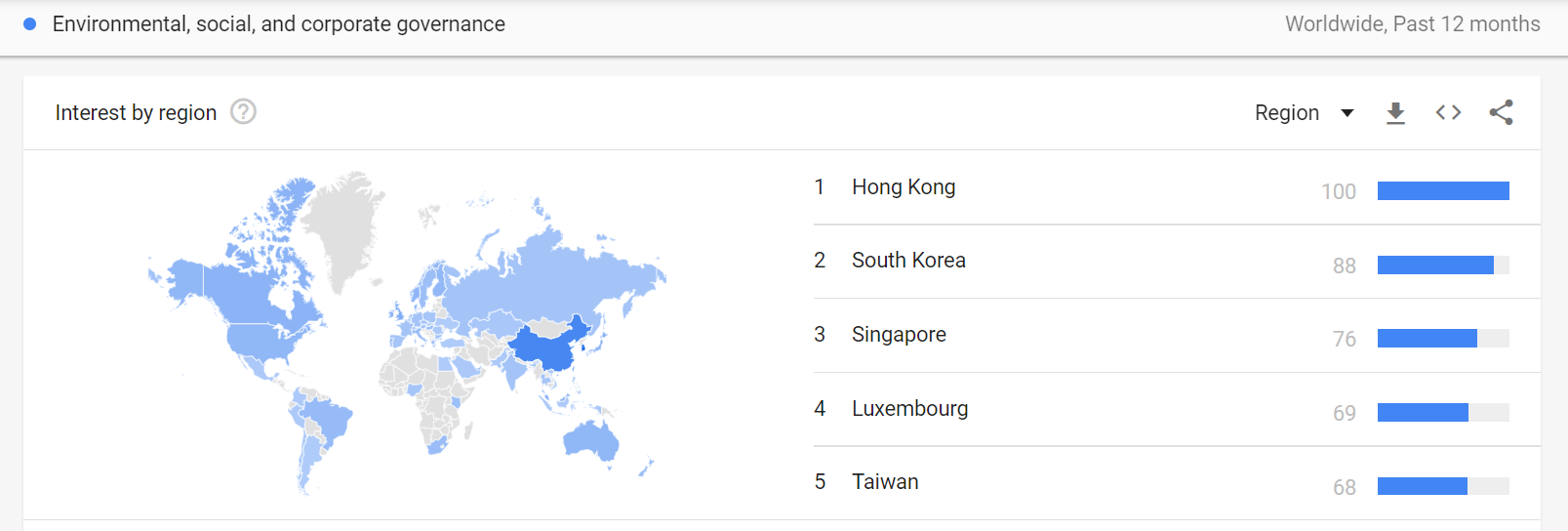

Globally, however, Hong Kong was the region with the highest overall interest in ESG in the past year. In September, the South China Morning Post reported that enrollments for ESG courses in Hong Kong hit an all time high in July 2022, suggesting that people in this region are not only aware of ESG but are actively pursuing long-term careers in the field.

Among the other regions with high search interest in ESG were South Korea, Singapore, Luxembourg, and Taiwan. The regions with the lowest interest were Iran, Syria, Algeria, Libya, and Turkey.

US lags behind other countries on ESG awareness

While global interest in ESG has been increasing since 2017, in the US, the topic didn’t start trending up until two years later, in 2019. After a significant spike in interest between December 2021 and February 2022, it reached peak popularity in May 2022 and has remained very high since then.

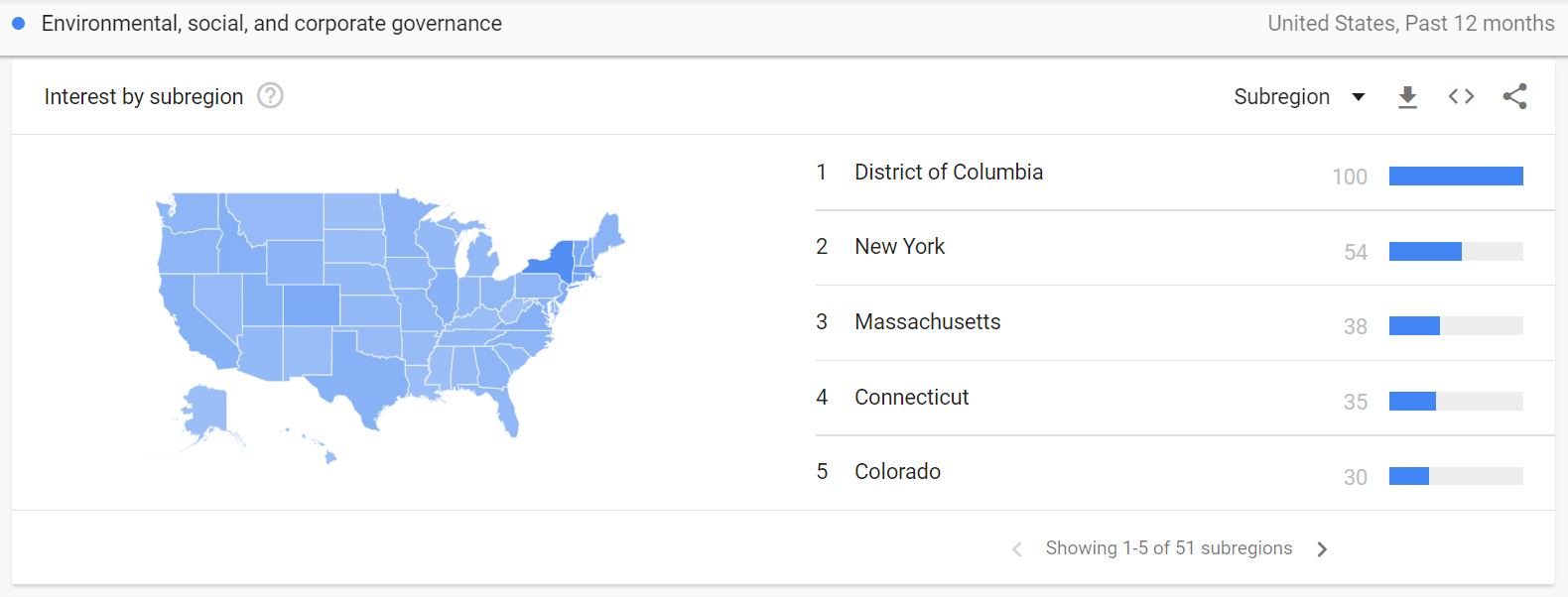

In the last 12 months, the topic was most popular on the East Coast. The District of Columbia led the pack in total searches, followed by New York, Massachusetts, Connecticut, and Colorado. On the other hand, search interest was lowest in West Virginia, Mississippi, North Dakota, Alaska, and Hawaii.

Investors drive early growth in ESG

The data also reveals a major shift in how people and businesses are thinking about ESG. Looking at the data from 2017, the most popular topics related to ESG worldwide were “investments” and “socially responsible investing”.

Among the most popular related search queries were:

- ESG investing

- MSCI ESG

- ESG index

- ESG fund

These trends indicate that, five years ago, people were primarily interested in learning about ESG investing. They also wanted information about the performance and ratings of specific ESG funds before adding them to their portfolios.

Fast forward to today, and the topic of “reporting” has climbed the list, surpassing interest in both ESG funds and socially responsible investing. Likewise, more people searched for “ESG report” than “ESG investing” in the past 12 months. These trends highlight how investors have driven ESG issues higher up on the corporate agenda, and prompted businesses to improve their ESG disclosure.

Financial disclosures, supply chain among trending topics in 2022

Google Search Trend data also reveals rising interest in other ESG-related topics:

- Deloitte: +100% year-over-year

- Ernst & Young: +90% year-over-year

- Greenwashing: +90% year-over-year

- Supply chain: +80% year-over-year

- U.S. Securities and Exchange Commission: +80% year-over-year

- Financial statement: +70% year-over-year

- PricewaterhouseCoopers: +70% year-over-year

- Audit: +70% year-over-year

These trends reveal that greenwashing has become a major concern, especially as new disclosure rules (like those coming out of the US SEC) emerge.

As companies think about integrating ESG into their financial statements and preparing for audits, many are seeking out the assistance of ESG consulting firms like Deloitte, Ernst & Young, and PricewaterhouseCoopers. Meanwhile, they’re also taking a closer look at their supply chains for ESG risks and issues.

Stay on top of the latest trends

The field of ESG is changing rapidly, and new risks and issues are emerging every day. We’ll keep an eye on these trends to see how they evolve.